does cash app report personal accounts to irs

Herein does Cashapp report to IRS. Tax Reporting for Cash App.

Changes To Cash App Reporting Threshold Paypal Venmo More

Does The Cash App Report To Irs.

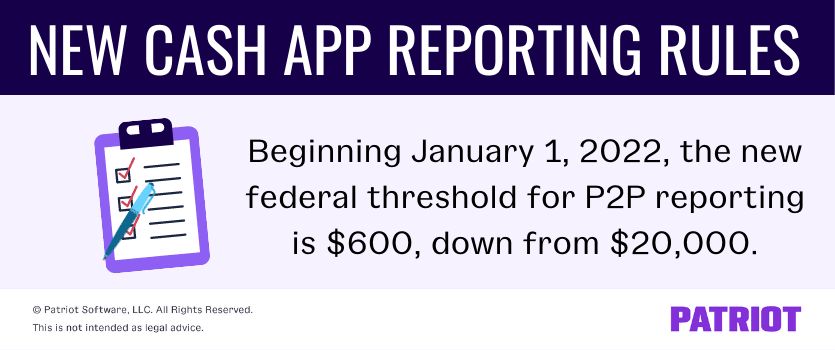

. Starting January 1 2022 if your Cash App Business account has gross sales of 600 or more in a tax year Cash App must provide a Form 1099-K to the IRS. As an example a Schedule E would be used by S-corporations and partnerships. Previous rules for third-party payment systems required them to report gross earnings over 20k or if the user had a total of more than 200 different transactions in a fiscal year.

Cash App Support Tax Reporting for Cash App. Does the cash app report personal accounts to IRS. In most cases you will report this income on a Schedule C filed with Form 1040.

By Tim Fitzsimons. Is your cash app not working. Personal Cash App accounts are exempt from the new 600 reporting rule.

Log in to your Cash App Dashboard on web to download your forms. For any additional tax information please reach out to a tax professional or visit the IRS website. Personal Cash App accounts are exempt from the new 600 reporting rule.

Certain Cash App accounts will receive tax forms for the 2021 tax year. Cash apps like Venmo Zelle and PayPal make paying for certain expenses a breeze but a new IRS rule will require some folks to report cash app transactions to the feds. As of January 1 2022 there are new rules for cash apps and electronic payment systems to report business transactions to the IRS.

Does Cash App Report Personal Accounts To IRS. It is vital that you keep accurate records of cash app transactions. Cash App for Business accounts will receive a 1099-K form for those who accept over 20000 and more than 200 payments per calendar year cumulatively with Square.

Want assistance in solving cash app related woes. The forms used may differ based on your business structure. Want to see the transaction history.

Keeping Records of Cash App Transactions. This new 600 reporting requirement does not apply to personal Cash App accounts. There Is NO 600 Tax Rule For Users Making Personal Payments On Cash App PayPal Others.

There are many queries of. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the Internal Revenue Service. Starting January 1 2022 if your Cash for Business account has 600 or more in gross sales in the 2022 tax year it will qualify for a Form 1099-K and Cash App is required to report it to the IRS.

Contact a tax expert or visit the IRS.

How To Buy Stocks On Cash App A Step By Step Guide Gobankingrates

Does Cash App Report Personal Accounts To Irs New Rules Frugal Living Coupons And Free Stuff

Cash App Report Personal Accounts To Irs Do I Have To Pay Taxes Pelham Plus

Cash App Bank Statement How To Get It

How Does The Irs Law Work On 600 Payments Through Apps Marca

Cash App Taxes 2021 Review New Name Same Free Tax Experience Tom S Guide

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

Cash App Report Personal Accounts To Irs Do I Have To Pay Taxes Pelham Plus

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Contact Cash App Support Square Support Center Us

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Venmo Cash App Paypal To Report Transactions Of 600 Or More To Irs Marketplace

Does Cash App Report Personal Accounts To Irs New Rules Frugal Living Coupons And Free Stuff

Tax Day Venmo And Paypal Users Face More Paperwork Under New Us Rules Us News The Guardian

Changes To Cash App Reporting Threshold Paypal Venmo More

Cash App Taxes Review Free Straightforward Preparation Service

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

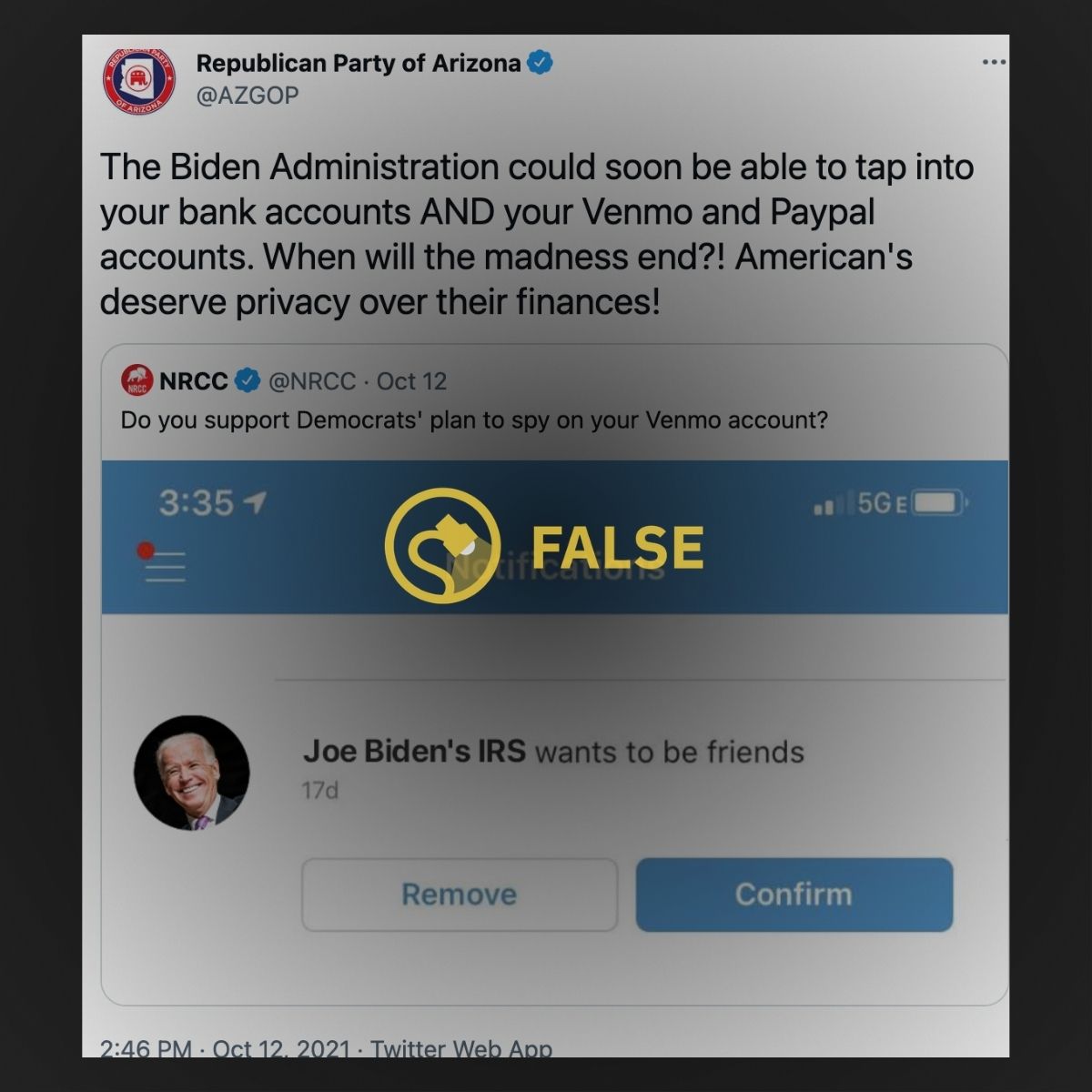

Are Biden And Dems Planning To Spy On Bank And Cash App Accounts Snopes Com

Cash App Square Cash Review Fees Comparisons Complaints Lawsuits