tax avoidance vs tax evasion south africa

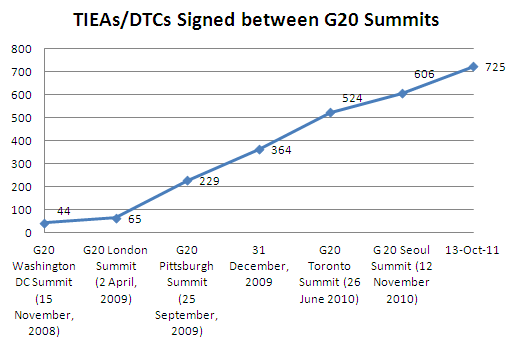

Diuga highlights the difference between evasion planning and avoidance. Tax avoidance tax evasion tax heavens illicit financial flows and global tax governance are real buzzwords that have come to dominate current international political and financial domains.

Differences Between Tax Evasion Tax Avoidance And Tax Planning

An example of tax avoidance would be importing unbuilt items that are charged at a reduced import taxes rate and thereafter getting them assembled in South Africa.

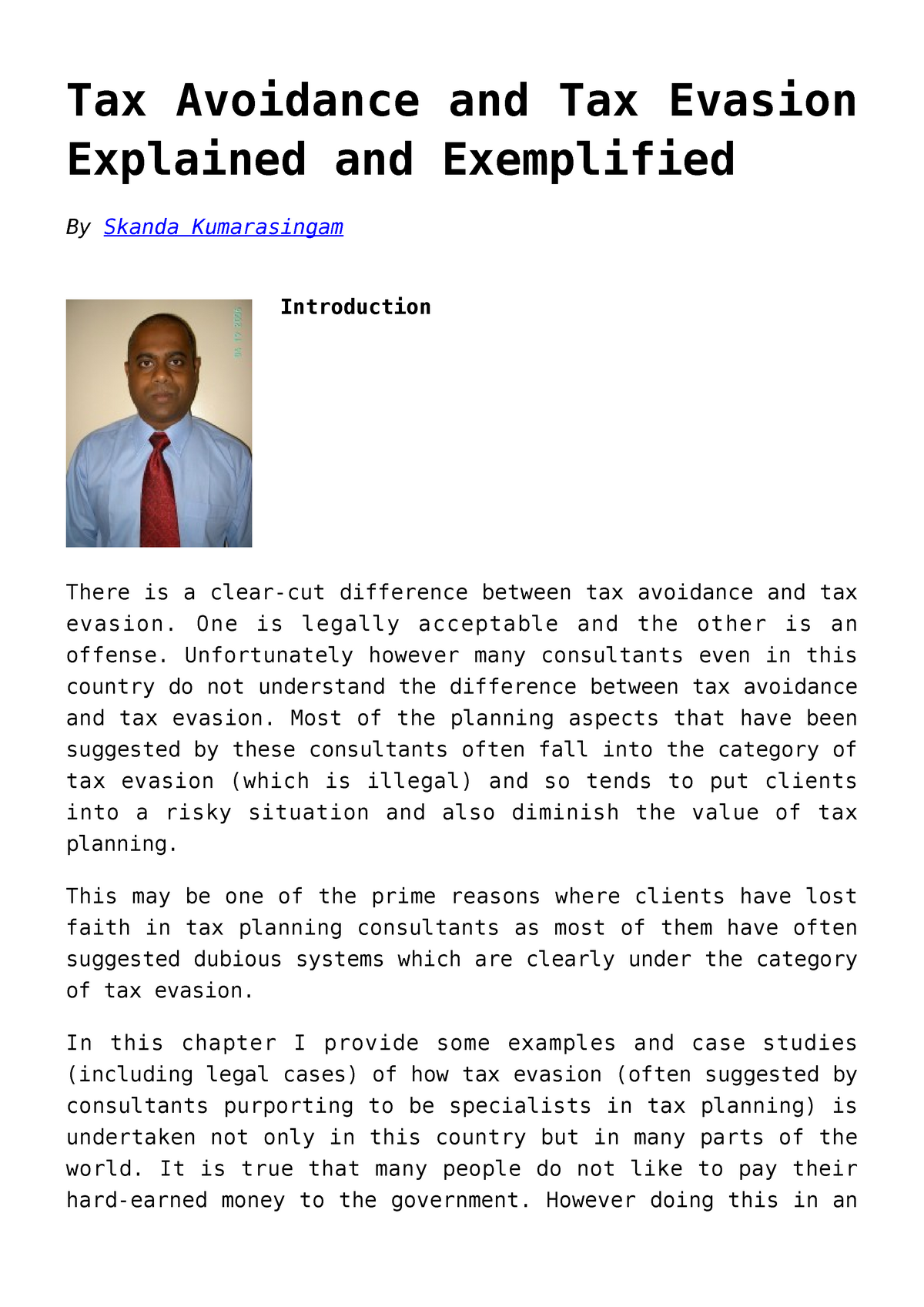

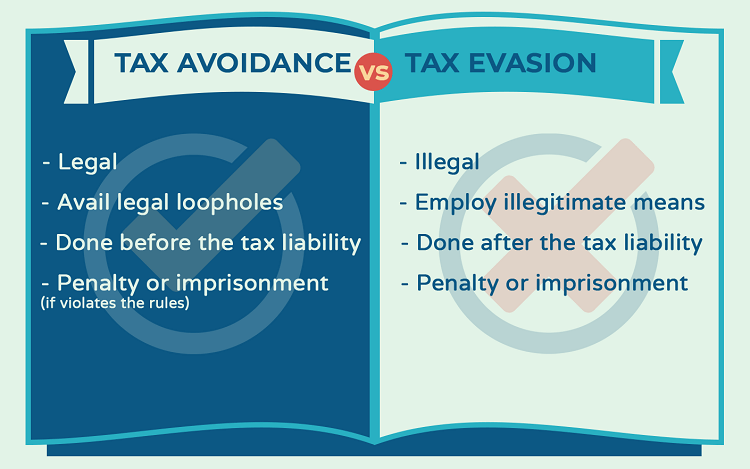

. The difference between tax avoidance and tax evasion boils down to the element of concealing. It is reasonable to presume that anyone would want to pay less tax and therefore it is. Tax avoidance is structuring your affairs so that you pay the least amount of tax due.

Usually tax evasion involves hiding or misrepresenting income. Acts need not fit under the taxing rules. First tax avoidance or evasion occurs across the tax spectrum and is not peculiar to any tax type such as import taxes stamp duties VAT PAYE and income tax.

Tax Avoidance is legal. What is tax evasion. Even if youre not formally charged with tax evasion you will be assessed fines if you file your return more than 60 days after the due date.

These are taxes that the deceased estate has. In instances of tax evasion where taxpayers attempted to mislead SARS the Commissioner is empowered to disregard the actual rights and obligations as created by a transaction and impose fines imprisonment or both. And 3 legitimate tax planning or tax mitigation.

Tax evasion on the other hand is using illegal means to avoid paying taxes. In tax avoidance you structure your affairs to pay the least possible amount of tax due. While tax evasion was generally regarded as an illegal and dishonest means to escape tax tax avoidance was viewed as a legitimate and continue reading Continue reading.

Tax avoidance understood as the use of the so-called loopholes in the tax legislation to reduce ones tax payments increasingly tops news charts. The above contract would not be considered valid if put into a verbal contract. Usually this constitutes fraud ie falsifying statements or.

For the sake of clarity please note the following. Pay a Penalty. Tax evasion and avoidance are both phenomena that are probably as old as taxation itself.

Discussions of tax avoidance often begin with an attempt to define and distinguish three broad concepts. Tax evasion on the other hand involves the use of illegal means of paying the least amount of tax. In South Africa like in most countries death and taxes go together in the form of inheritance taxes.

Africa Africas problem with tax avoidance. Written Contracts Property Blog Articles nd Verbal contracts are not recommended with big agreements like sale agreements lease agreements employment agreements or any other agreements with lots of terms that both parties will need to agree on. Tax Evasion vs.

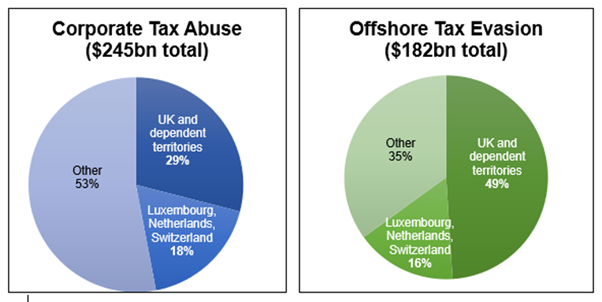

2 impermissible tax avoidance. By contrast tax evasion is the general term for efforts by individuals firms trusts and other entities to evade the payment of taxes by illegal means. Tax evasion and avoidance activities do largely contribute to the poor per formance of state revenue mobilization in developing countries.

If you act with the purpose of avoiding or defeating any tax owed to the IRS you could be fined up to 250000. Examples of tax avoidance involve using tax deductions changing ones business structure through incorporation or establishing an offshore company in a tax haven. In tax evasion you hide or lie about your income and assets altogether.

Tax Avoidance vs Tax Evasion. Posted May 23 2019 by Jono. Using unlawful methods to pay less or no tax.

Payment of taxes is often a sensitive topic to discuss and everyone at some stage is obligated to pay their fair share. The aggregate credit allowed may not exceed an amount which bears to the total tax payable in South Africa the same ratio as the foreign income taxable in South Africa bears to the total taxable income. Tax avoidance is the legitimate minimizing of taxes using methods included in the tax code.

Tax Avoidance vs Tax Evasion. The difference between tax evasion and tax avoidance largely boils down to two elements. While there is typically agreement over the meaning of tax evasion the other two categories are more contentious2 22.

A taxpayer may structure his affairs in a manner that would allow him to pay the least amount of tax. The failure-to-file penalty is 10 times more than the failure-to-pay penalty. Federal and state tax regulatory bodies provide for deductions credits and adjustments to income that will lower the tax burden on taxpayers.

Every year African countries lose at least 50 billion in taxes more than the amount of foreign development aid. Thus in the past it was generally accepted that there was a simple distinction between unlawful tax evasion and lawful tax avoidance. Tax Evasion is illegal.

Wherever and whenever authorities decide to levy taxes individuals and firms try to avoid paying them. Tax evasion on the other hand refers to efforts by people businesses trusts and other entities to avoid paying taxes in unlawful ways. Legal Aspects of Tax Avoidance and Tax Evasion Two general points can be made about tax avoidance and evasion.

South Africa incorporated general anti-avoidance rules. Businesses avoid taxes by taking all legitimate deductions and by sheltering income from taxes by setting up employee retirement plans and other means all legal and under the Internal Revenue Code or. Secondly legislation that addresses avoidance or evasion must necessarily be imprecise.

Foreign tax relief. While you get reduced taxes with tax avoidance tax evasion can result in. As most taxpayers know tax avoidance is when a taxpayer arranges his affairs in a legal manner to reduce his tax payable whereas tax evasion is.

The types of initiatives aimed at addressing tax loss range amongst others from education-led awareness raising campaigns on the importance of tax contributions and the harm that tax evasion and avoidance has on the health of the economy the use of automation and digital technologies to increase tax collections and to facilitate the transfer of information on. Credit in the form of a rebate from South African tax is allowed for taxes paid on foreign income. Tax avoidance is the legal use of the provisions of the tax laws to ones advantage to reduce the amount of tax that is payable by means that are within the law.

Furthermore interest on the outstanding amount is payable as well as an additional tax of up to 200 of the outstanding amount. This might be underreporting income inflating deductions without proof hiding or not reporting cash transactions or hiding money in offshore accounts.

Tax Avoidance And Evasion In Africa Roape

Tax Evasion Statistics 2022 Update Balancing Everything

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Avoidance Vs Tax Evasion Infographic Fincor

Offshore Tax Havens Information Recherche Et Analyse La Conversation

Pdf Addressing Tax Evasion Tax Avoidance In Developing Countries Semantic Scholar

Tax Evasion And Tax Avoidance Explained Pdf Tax Avoidance And Tax Evasion Explained And Studocu

Unu Wider Blog How Global Tax Dodging Costs Lives

Pdf Tax Evasion Tax Avoidance And Tax Expenditures In Developing Countries A Review Of The Literature Semantic Scholar

Tax Evasion Statistics 2022 Update Balancing Everything

Analysis Of The Causes Of Tax Evasion And Avoidance Download Table

Pdf Addressing Tax Evasion Tax Avoidance In Developing Countries Semantic Scholar

Taxpayer Income Tax Concept Burden Avoid Evasion Loopholes Etsy Pictogram Tax Investing

Tackle Tax Evasion To Fuel Africa S Development

Pdf Addressing Tax Evasion Tax Avoidance In Developing Countries Semantic Scholar

Tax Avoidance Costs The U S Nearly 200 Billion Every Year Infographic

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Differences Between Tax Evasion Tax Avoidance And Tax Planning